© 2021-2025 Xenon Connect Limited. All rights reserved - Terms - Privacy - Data Security

Analyse. Detect. Cleanse. Review.

A connection is created between Xenon Connect and Xero, QuickBooks Online, Sage or FreeAgent which pulls in your bookkeeping data automatically every night, ensuring that Xenon Connect stays up to date with all transactional data.

Manual interim sync processes can be actioned at the click of a button.

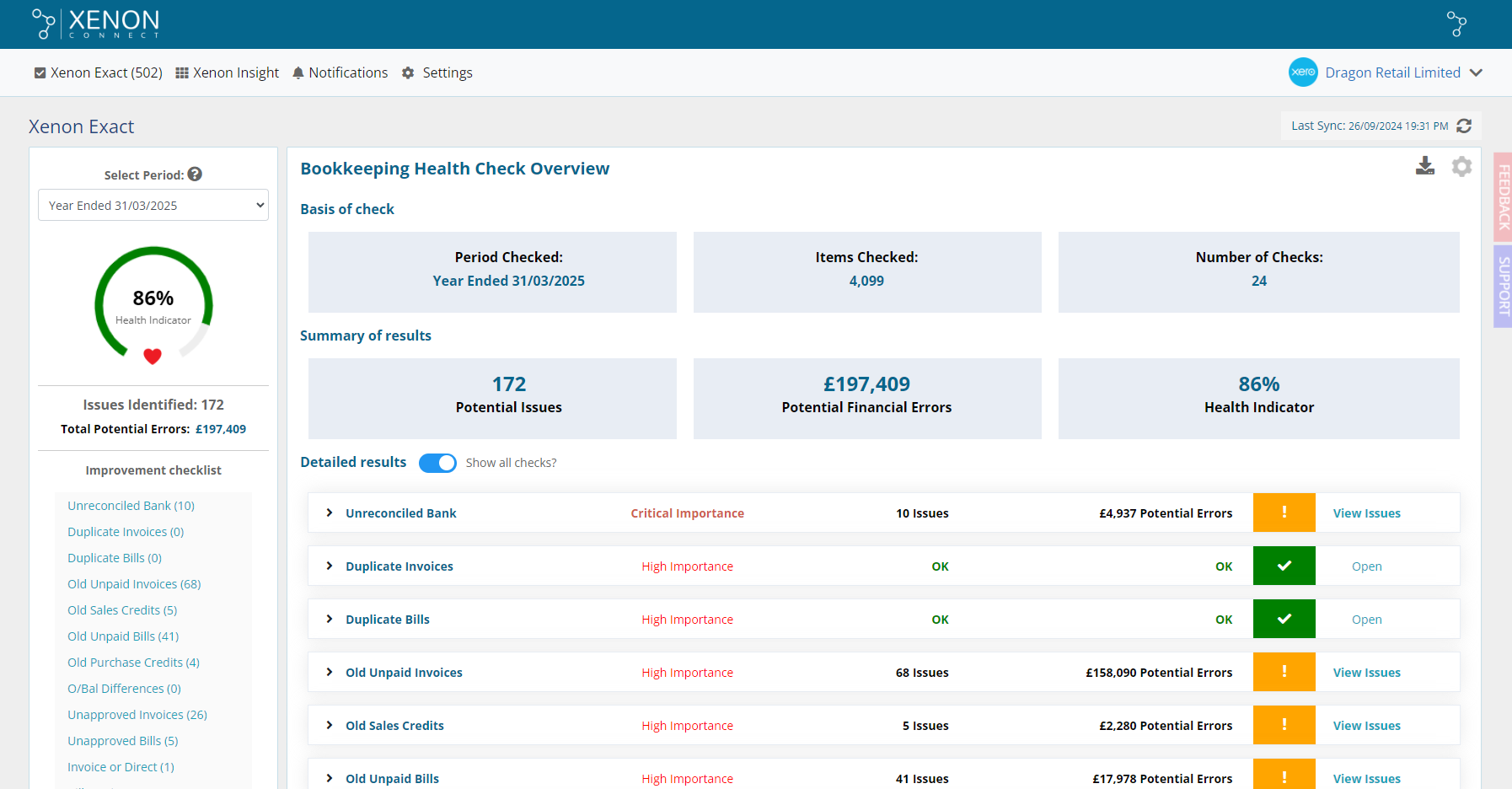

The Xenon Exact area automatically analyses every transaction in the background.

Any potential errors and issues found within your bookkeeping data are brought to your attention in the form of a Bookkeeping Health Checklist – allowing you to pinpoint where your time is best spent.

Xenon Insights is a suite of 9 financial KPIs which highlight the current performance and position of the business.

An alert notification is created when various conditions surrounding the business financials require your attention.

Better quality bookkeeping data. Faster.

Xenon Connect’s Bookkeeping Data Checks analyse your business’s Xero, QuickBooks Online, FreeAgent & Sage data, automatically detect bookkeeping issues and help you to quickly fix them.

The result is accurate financial data that you can rely on as a basis for making better business decisions and for reducing the risk of a tax authority compliance review.

Identify the number of bank transactions that require explaining, reconciling or both.

Identify customer invoices that have a high probability of having been duplicated in error.

Identify supplier bills that have a high probability of having been duplicated in error.

Identify older invoices that should have already been paid by the customer.

Identify older bills that should have already been paid to the supplier by the business.

Identify customers and suppliers that have a high probability of being added to the system more than once, in error.

Identify customers and suppliers that have at least one default account or tax code missing .

Identify transactions that have been coded to an account that is not the default account for the particular contact.

Identify contacts that have not been used for a long time, or at all.

Identify bank payments that have been processed directly to an account code when an unpaid bill exists for the same supplier.

Identify bank deposits that have been processed directly to an account code when an unpaid invoice exists for the same customer.

Identify transactions that have been given a tax code that is not the default tax code for the particular contact.

Identify customer invoices that have been created, but are marked with a status of “Draft” or “Submitted”.

Identify supplier bills that have been created, but are marked with a status of “Draft” or “Submitted”.

Identify transactions that have been coded to a particular expense account even though the transaction’s value is high.

Identify transactions that have been coded to an account of type “Fixed Asset” even though the transaction’s value is low.

Identify supplier contacts which have transactions that have been coded to more than one account code.

Identify supplier contacts which have transactions that have been coded to more than one tax code.

Identify customer sales credit notes that are old and not yet attached to an invoice or refunded.

Identify supplier purchase credit notes that are old and not yet attached to a bill or refunded.

Identify transactions that have been coded to a broad/vague account code and are greater than a specific value.

Identify differences between the balance sheet in the bookkeeping software and statutory accounts filed with Companies House.

Identify sales invoices and direct deposits that have been posted to a sales account without a VAT/sales tax code applied.

Identify supplier bills and direct payments that have been posted to an expense account without a VAT/purchase tax code applied.

Monitor growth. Assess financial position. Avoid nasty surprises.

Xenon Connect’s Insights allow you to monitor the 9 key performance and position indicators which form the lifeblood of the business.

The result is relevant figures throughout the year which reduce the risk of nasty surprises and provide the foundations for future growth planning.

Review actual monthly sales income against existing budgets, automatic targets or manual targets.

Compare current cash and bank balances with short, medium and long-term expected outgoings.

Review a summary of the current Bookkeeping Health Check results.

A graphical monthly comparison of Sales Income, Gross Profit and Net Profit figures.

An up to date estimate of the corporation tax liability in the current and previous 2 years.

Review of the current position of each director’s loan account, to avoid overdrawn loan accounts.

An estimate of business valuation, based upon the chosen sales, profit or net asset based model.

A monthly comparison of the ability of the business to manage it’s cash flow position.

A review of the level of cumulative profit reserves available to be extracted as dividend.

Automatic. Timely. Portal & Email based.

Get alerted within Xenon Connect and via regular update emails when something significant occurs or needs to occur.

Xenon Connect will keep an eye on your actual sales figure for the current month. Receive a notification when your actual sales figure exceeds your target sales figure.

Xenon Connect detects if you are not yet VAT registered and informs you when the business’ taxable sales figure breaches (or is approaching) the current VAT registration threshold (UK).

Xenon Connect detects when your accounting year end is. Get notified when your year end is approaching so that you can make preparations to get your year end figures in order.

‘A very useful, powerful add-on to identify matters requiring different levels of attention in Xero accounting files.

The client overall panorama is good as you can compare how different clients manage their accounts and can then drill down in specific areas.’

© 2021-2025 Xenon Connect Limited. All rights reserved - Terms - Privacy - Data Security